When Anthropic announced Claude Code Security on February 20, 2026, many security practitioners and operators had the same reaction: why did CrowdStrike stock fall on that news? On the surface, the connection looks weak. Anthropic’s announcement describes a code-focused capability that scans codebases for vulnerabilities and suggests patches for human review in a limited research preview. CrowdStrike, by contrast, is generally understood as a platform company associated with endpoint, cloud, identity, and detection/response operations rather than a code-review assistant. (Anthropic)

Yet the stock-market reaction was broad and immediate. Bloomberg reported a selloff across multiple cybersecurity names after the announcement, and Investors.com described a similar move across cyber and software-development stocks tied to fears that AI vendors are moving deeper into workflows historically owned by established software companies. (Bloomberg.com)

The right explanation is not “the market is crazy,” and it is also not “Claude Code Security directly replaces CrowdStrike.” The better explanation is that the market often reprices future budget-risk narratives e sector exposure before it works through product-level overlap in detail. This article breaks that down in a way that is useful to both investors and hard-core security engineers.

What Anthropic Actually Announced

Anthropic’s official announcement is more specific than many headlines. It says Claude Code Security is:

- a capability built into Claude Code on the web,

- available in a limited research preview,

- designed to scan codebases for vulnerabilities,

- and designed to suggest targeted patches for human review. (Anthropic)

Anthropic also describes a multi-stage verification process for findings, severity ratings, confidence ratings, and a workflow where nothing is applied without human approval. The announcement repeatedly frames the tool as a defender-oriented capability for finding and fixing vulnerabilities in source code and refining deployment responsibly with early users. (Anthropic)

That framing matters. It places the feature in the developer/AppSec/remediation part of the security lifecycle, not automatically in runtime detection-and-response operations.

What the Market Actually Did

Bloomberg’s report on the day of the announcement described a broad move lower in cyber stocks, not just one isolated name. The article’s title itself captures the pattern: “Cyber Stocks Slide as Anthropic Unveils Claude Security Tool,” and Bloomberg timestamps the piece to February 20, 2026. (Bloomberg.com)

Investors.com similarly described a broad selloff and noted that investors were reacting to the idea that LLM vendors entering cybersecurity could create competition for enterprise security budgets. It also cited analyst commentary suggesting some names may have been punished more than direct competitive overlap alone would justify. (Investors)

This is a key clue. When multiple cyber names move together on one headline, the market is usually trading a theme ou basket, not evaluating each company’s feature map in real time.

Why CrowdStrike Stock Fell Even If the Product Overlap Is Not One-to-One

The fastest way to make sense of this is to separate technical overlap from market repricing logic.

A security architect asks a precise question:

“Does Claude Code Security replace what CrowdStrike does in endpoint, detection, or response?”

A market participant often asks a broader question:

“Does this increase the probability that AI vendors will capture more security-related budget and pressure incumbents over time?”

Those are very different questions. The first is product-specific. The second is portfolio-level and narrative-driven. On headline day, the second question usually dominates.

In other words, CrowdStrike stock can fall on Claude Code Security news sem the market claiming that the two products are identical. The market may simply be pricing in the possibility that AI vendors are moving into higher-value security workflows and that this could alter future spending patterns, renewal negotiations, or valuation multiples across the cybersecurity and enterprise-software sectors. (Investors)

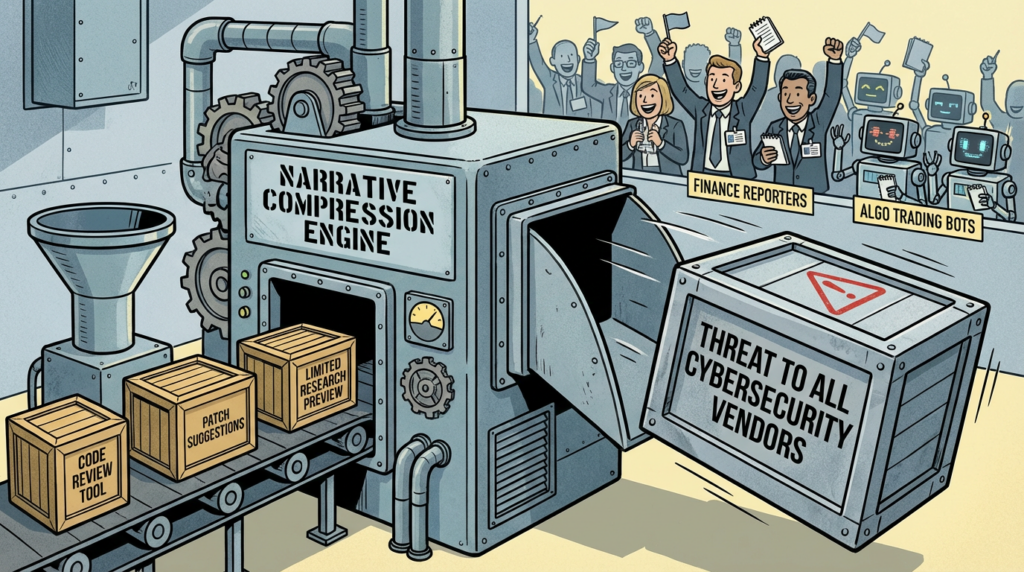

The Core Mechanism Was Sector Basket Selling

The broadness of the move is the point. Bloomberg and Investors.com both described declines across multiple names. That pattern strongly suggests sector basket selling rather than a clean company-by-company fundamental reassessment. (Bloomberg.com)

A basket selloff can happen for several reasons at once.

Theme and ETF exposure gets cut first

When a market-moving AI announcement arrives, many funds do not wait to model exact product overlap by vendor. They reduce exposure to a theme:

- cybersecurity software,

- dev tools,

- “AI disruption risk” software,

- or high-multiple software in general.

If enough capital is positioned around themes, the first move is broad. Individual differentiation comes later, after analyst notes, management commentary, and customer channel checks.

Quant and systematic flows amplify the move

Systematic strategies can accelerate this dynamic because they react to price moves, volatility, correlations, and news signals. Once a few liquid names in the same group sell off, others often move in sympathy. This is especially true in sectors where investors treat names as a relative-value cluster.

AI disruption narratives compress categories

Headlines move faster than architecture diagrams. “AI now does security tasks” can quickly become “security vendors face pressure,” even though the actual feature may target one layer of the lifecycle. The shorter the headline, the more category boundaries disappear. That is not ideal for precision, but it is very common in financial markets.

Why Security Engineers Felt the Move Was Misaligned

Security engineers tend to think in layered workflows:

- source code and code review

- build pipelines and CI/CD gates

- application security testing and remediation

- identity and access control

- endpoint protection and telemetry

- cloud security posture and workload runtime

- SIEM/XDR/MDR and incident response

From that perspective, Claude Code Security belongs mainly to the codebase analysis and remediation assistance layer (at least based on the current announcement), while CrowdStrike’s core value proposition sits much more heavily in operational security outcomes and platformized defense workflows. (Anthropic)

That is exactly why the market move felt “off” to practitioners. Their mental model is segmented by function and deployment stage. The market’s mental model on day one was segmented by future spending narratives.

Both views can be simultaneously valid:

- The market may be directionally repricing a long-term AI encroachment story.

- The first-day move may still be too broad relative to immediate product substitution risk.

Claude Code Security and CrowdStrike Operate in Different Parts of the Security Lifecycle

The easiest way to reduce confusion is to compare them by lifecycle position, buyer, and evidence model.

| Dimensão | Claude Code Security as announced | CrowdStrike platform positioning | Why this still affected CrowdStrike stock |

|---|---|---|---|

| Primary focus | Codebase vulnerability discovery and patch suggestions | Operational security platform across endpoints/cloud/identity (public platform framing) | Markets traded “security budget pressure” as a broad theme |

| Workflow stage | Development and remediation workflow | Runtime and operational defense workflows | Headlines blurred lifecycle distinctions |

| Decision maker | Engineering/AppSec/DevSecOps leaders | Security operations leadership, platform teams, CISO org | Budget ownership can converge at CIO/CISO/CFO level |

| Output style | Findings, patch suggestions, human review | Telemetry-driven prevention/detection/response and broader platform outcomes | Investors priced potential future overlap, not current exact scope |

| Product status | Limited research preview | Mature commercial platform business | Preview products can still shift market expectations |

Anthropic’s announcement clearly supports the Claude Code Security side of this table, and CrowdStrike’s public filings and investor relations materials support the platform framing on its side. (Anthropic)

The table does não claim there is zero overlap forever. It claims the overlap is not best understood as “same product, different brand.” That distinction matters.

What the Market May Have Been Pricing In

The better explanation for the CRWD move is second-order repricing, not immediate first-order substitution.

1. Budget reallocation risk

If AI-native tools begin to absorb more tasks in secure coding, vulnerability triage, or remediation recommendation workflows, investors may assume some security budgets become more contested. That alone can be enough to pressure valuations in a high-expectation sector. Investors.com explicitly highlighted concern that LLM providers are entering the cybersecurity landscape and may compete for enterprise security budgets. (Investors)

2. Procurement leverage risk

Even before a customer replaces anything, buyers may use AI entrants as leverage in negotiations with incumbents. Markets care about this possibility because valuation multiples in software often depend on assumptions about pricing durability and expansion rates.

3. Platform-creep risk from AI vendors

A narrow feature today can imply a broader ambition tomorrow. Investors often price the possibility that a vendor will expand from one workflow into adjacent ones. They do not need proof of full expansion to adjust positioning; they only need a credible direction of travel.

4. Multiple compression in AI-sensitive software sectors

When investors become more worried that AI may flatten margins or commoditize parts of existing workflows, they often compress valuation multiples across a sector before revenue impact is visible. This is one reason broad selloffs can look premature to practitioners but still occur repeatedly in software markets.

What the Selloff Did Not Prove

The stock reaction did não prove that:

- Claude Code Security already replaces CrowdStrike,

- endpoint and response platforms are suddenly commoditized,

- or the market has precisely identified long-term winners and losers in one session.

A one-day move on a headline is often a rough repricing of uncertainty. It tells you what investors are worried about. It does not tell you that they have correctly mapped the exact product boundaries.

This is especially true when the triggering announcement itself describes a limited research preview and a human-review workflow for codebase findings and patches. (Anthropic)

A More Useful Mental Model for Both Investors and Practitioners

Instead of arguing “rational” versus “irrational,” use this sequence.

| Estágio | What happens | What gets priced quickly | What gets priced later |

|---|---|---|---|

| 1 | New AI security-adjacent feature launches | Narrative of AI expansion into cyber | Product-specific adoption and limits |

| 2 | Financial headlines spread | Sector/theme risk and basket selling | Category-by-category budget impact |

| 3 | Broad stocks move together | Correlations, ETF effects, de-risking | Company-specific moat strength |

| 4 | Analysts and customers react | Revised narrative and relative positioning | Real procurement and retention outcomes |

| 5 | Time passes | Fundamentals reassert | Winners/losers separate more clearly |

This framework explains why the move can feel messy in the moment and still be understandable.

The Technical Boundary Matters More Than the Headline Suggests

One of the easiest mistakes in discussing this story is collapsing all “security” into one bucket. In practice, security outcomes depend on multiple layers that do different jobs:

- finding bugs in source code,

- patching and secure coding practices,

- testing applications before deployment,

- monitoring systems at runtime,

- detecting adversary behavior,

- containing incidents,

- and proving remediation across fleets.

Claude Code Security, as publicly described, appears to strengthen one important part of that chain: the ability to reason over codebases and suggest patches for human review. That can be genuinely valuable. It does not eliminate the need for runtime telemetry, endpoint visibility, identity controls, or incident response workflows. (Anthropic)

This distinction becomes obvious when you look at active exploitation events.

A CVE Reality Check Why Runtime Security Budgets Still Exist

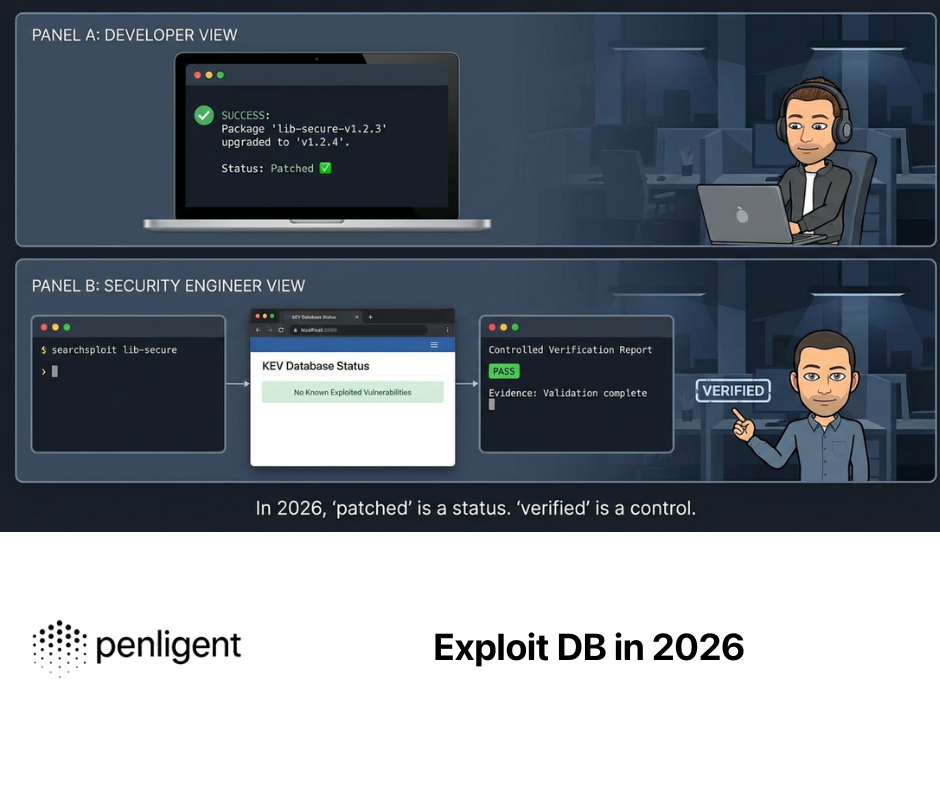

Consider CVE-2026-2441, a Chrome CSS use-after-free flaw. Google’s Chrome Releases page states that the stable channel update on February 13, 2026, included the fix and explicitly says Google is aware that an exploit for CVE-2026-2441 exists in the wild. It also lists the fixed versions for Windows/Mac and Linux. (Chrome Releases)

NVD’s record for CVE-2026-2441 describes it as a use-after-free in CSS in Google Chrome prior to 145.0.7632.75 that allowed arbitrary code execution inside a sandbox via a crafted HTML page. NVD also shows that the CVE is in CISA’s Known Exploited Vulnerabilities catalog, including date added and due date fields in the record history. (NVD)

Why does this matter in an article about CrowdStrike stock and Claude Code Security?

Because active exploitation forces organizations to answer operational questions that code analysis alone does not solve:

- Which endpoints are still exposed?

- Which versions are actually deployed?

- Which systems show suspicious post-exploitation behavior?

- How fast can the team prove remediation?

- What evidence can be shown to leadership, auditors, or regulators?

This is where runtime and operations-focused security platforms continue to matter, regardless of improvements in AI-driven code analysis.

What CVE-2026-2441 Teaches About the Limits of Category Collapse

CVE-2026-2441 is a useful example because it highlights several realities at once.

First, vulnerabilities are not just a developer problem or just a runtime problem; they become a cross-functional problem the moment active exploitation is confirmed. Google’s “exploit exists in the wild” language makes that operational urgency explicit. (Chrome Releases)

Second, remediation is not the same thing as visibility. A team may know a patch exists but still struggle to verify patch coverage across diverse endpoints and user populations.

Third, even if AI tools improve upstream vulnerability discovery and patch recommendation, organizations still need downstream detection and response capabilities to manage exploited vulnerabilities in production environments.

That is why broad “AI replaces cyber” narratives are too crude for serious security teams, and also why investors may still overreact or underreact in the short run depending on what they are actually pricing.

Practical Questions Security Teams Should Ask Right Now

If you are a security leader or engineer trying to translate this news into action rather than argument, the right move is to separate evaluation into layers.

Questions for AI code security evaluation

- Does the tool materially improve signal quality for real vulnerabilities?

- What is the false-positive/false-negative profile in your codebase?

- How useful are the patch suggestions in real repositories?

- How much human review time is saved versus shifted?

- Can findings be integrated into existing AppSec workflows?

- How are confidence and severity scores calibrated?

Anthropic’s announcement specifically mentions multi-stage verification, severity ratings, confidence ratings, and human approval. Those are good prompts for pilot evaluation. (Anthropic)

Questions for runtime security and response continuity

- Does this reduce the need for endpoint telemetry? (Usually no.)

- Does this reduce incident response workload during active exploitation? (Usually not directly.)

- Does this replace identity, cloud, or XDR controls? (Not based on current scope.)

- Does it improve patch velocity or reduce vulnerable code introduction? (Potentially yes, and worth testing.)

Questions for budget planning

- Is this a net-new spend, a productivity gain, or a substitution candidate?

- Which line items could be pressured over time?

- Which line items are tied to operational outcomes and compliance obligations that remain non-negotiable?

- Are we conflating code-security productivity tools with runtime defense platforms?

These are the questions that produce a better answer than “the stock fell so something must be obsolete.”

A Comparison Table You Can Use in Internal Discussions

Here is a more executive-friendly version that works for board prep, budget reviews, and technical leadership alignment.

| Executive question | Best evidence-based answer today | Risk of oversimplified interpretation |

|---|---|---|

| “Did Claude Code Security directly cause CrowdStrike to become less useful?” | No direct evidence of that from the announcement; it is a codebase scanning and patch suggestion capability in preview | Equating one layer of security workflow with the entire operational stack |

| “Why did CrowdStrike stock fall then?” | Broad sector repricing, AI budget-risk narrative, basket selling across cyber names | Treating stock movement as a precise product comparison |

| “Should we cut endpoint/XDR spend?” | Not based on this news alone; operational telemetry and response needs remain | Confusing remediation assistance with runtime detection/response |

| “Should we pilot AI code security tools?” | Yes, if done with clear metrics and integration criteria | Piloting without defining what success actually means |

| “Could AI vendors pressure cyber software pricing over time?” | Yes, possibly in some workflows; monitor category-specific impact | Assuming near-term universal disruption |

A Defensive Validation Example for CVE-2026-2441 Exposure Tracking

Because real security teams need proof, not headlines, here is a practical Python example for checking Chrome versions in an endpoint inventory export against the fixed version floors from Google’s Chrome stable bulletin. This is a defensive validation helper, not exploit code. The version floors are supported by Google’s release note and NVD’s affected-version description. (Chrome Releases)

from dataclasses import dataclass

from typing import Optional, Tuple

# CVE-2026-2441 context from Google's Feb 13, 2026 Chrome stable update:

# Windows/Mac fixed at 145.0.7632.75/76

# Linux fixed at 144.0.7559.75

# NVD describes Chrome prior to 145.0.7632.75 as affected (with OS-specific CPE details in change history).

FIXED_FLOORS = {

"windows": (145, 0, 7632, 75),

"macos": (145, 0, 7632, 75),

"linux": (144, 0, 7559, 75),

}

@dataclass

class Endpoint:

hostname: str

os_family: str

browser_name: str

browser_version: str

def parse_version(ver: str) -> Optional[Tuple[int, ...]]:

try:

return tuple(int(p) for p in ver.split("."))

except Exception:

return None

def lt_ver(a: Tuple[int, ...], b: Tuple[int, ...]) -> bool:

n = max(len(a), len(b))

a = a + (0,) * (n - len(a))

b = b + (0,) * (n - len(b))

return a < b

def assess(ep: Endpoint) -> str:

if ep.browser_name.lower() not in {"chrome", "google chrome"}:

return "REVIEW_NON_CHROME_BROWSER"

os_key = ep.os_family.lower()

if os_key not in FIXED_FLOORS:

return "UNKNOWN_OS"

v = parse_version(ep.browser_version)

if v is None:

return "UNKNOWN_VERSION"

if lt_ver(v, FIXED_FLOORS[os_key]):

return "BELOW_FIXED_FLOOR"

return "AT_OR_ABOVE_FIXED_FLOOR"

fleet = [

Endpoint("win-001", "windows", "chrome", "145.0.7632.74"),

Endpoint("mac-014", "macos", "chrome", "145.0.7632.76"),

Endpoint("lnx-210", "linux", "chrome", "144.0.7559.74"),

Endpoint("ws-900", "windows", "edge", "145.0.0.0"),

]

for e in fleet:

print(f"{e.hostname}: {assess(e)}")

This kind of script illustrates the central point of the article: real-world security operations are measured by verifiable exposure and remediation evidence, not only by whether a new AI tool exists in an adjacent layer.

A Lightweight Event-Study Template for Tracking Future Reactions

If you plan to write or brief on these market reactions repeatedly, a simple event-study framework is more useful than narrative-only commentary. The goal is to compare the specific stock move to a cyber basket and a broad market index around the event date.

# Conceptual event-study template (plug in your own market data source)

import pandas as pd

# CSV columns expected:

# date, crwd_close, cyber_etf_close, software_etf_close, sp500_close

df = pd.read_csv("prices.csv", parse_dates=["date"]).sort_values("date")

for col in ["crwd_close", "cyber_etf_close", "software_etf_close", "sp500_close"]:

df[col.replace("_close", "_ret")] = df[col].pct_change()

event_date = pd.Timestamp("2026-02-20")

window = df[(df["date"] >= event_date - pd.Timedelta(days=5)) &

(df["date"] <= event_date + pd.Timedelta(days=5))].copy()

window["crwd_excess"] = window["crwd_ret"] - window["sp500_ret"]

window["cyber_excess"] = window["cyber_etf_ret"] - window["sp500_ret"]

print(window[[

"date", "crwd_ret", "cyber_etf_ret", "software_etf_ret",

"sp500_ret", "crwd_excess", "cyber_excess"

]])

If CRWD and a cyber ETF both gap down materially on the announcement date and move in the same direction more than the broad market alone explains, that supports the “basket repricing” interpretation. Bloomberg’s reporting on a broad cyber-stock slide is exactly the kind of event context this framework is built to analyze. (Bloomberg.com)

What Investors Should Watch Next Instead of Arguing About the One-Day Move

The more useful follow-up question is not “was the first reaction perfect?” It is “what evidence would confirm or weaken the market’s fear?”

Signals that would support the bearish repricing narrative

- AI code security tools demonstrate strong enterprise adoption in meaningful segments.

- Buyers start consolidating or renegotiating AppSec/developer-security spend around AI-native offerings.

- Incumbents report pressure in workflow categories close to code scanning and remediation.

- AI vendors expand beyond codebase analysis into adjacent security operations workflows.

Signals that would weaken the broad selloff thesis

- Adoption remains narrow, experimental, or concentrated in specific use cases.

- AI features are additive productivity layers rather than replacements for platforms.

- Security teams continue to treat runtime telemetry, detection/response, and identity controls as protected budgets.

- Incumbents incorporate similar AI capabilities while preserving platform value and pricing leverage.

This is where time and execution matter more than headlines.

What Security Engineers Should Watch Next Instead of Reading Stock Moves as Product Truth

Security teams should avoid using a stock chart as a substitute for architecture decisions. Instead, they should run structured pilots and define success criteria before changing their tooling mix.

A sensible pilot framework for an AI code-security tool should include:

- representative repositories (not toy projects),

- known historical bugs and bug classes,

- time-to-triage and time-to-remediation metrics,

- false-positive review burden,

- patch correctness validation,

- and integration with existing issue tracking and remediation workflows.

The goal is to determine whether the tool changes real engineering throughput and risk reduction, not just whether it produces impressive demos.

The shared theme is evidence-driven validation. When markets overreact or underreact to AI entering security, security teams still need to prove what is actually exploitable, what is actually patched, and what remains exposed. Penligent’s positioning as an AI-powered penetration testing platform is relevant at that level: helping teams generate reproducible validation workflows and report-ready outputs rather than relying on assumptions. (Penligente)

A second clean connection is educational and operational context. Penligent’s Hacking Labs coverage on recent CVEs such as CVE-2026-2441 aligns with the “prove, don’t assume” mindset that this article argues for. If readers want a practitioner-oriented breakdown of CVE-2026-2441 and its implications for validation and remediation, Penligent’s related articles fit naturally as follow-up reading. (Penligente)

The Bottom Line

CrowdStrike stock fell after Claude Code Security launched because the market treated Anthropic’s announcement as a signal of broader AI expansion into security-related workflows, then repriced a basket of cybersecurity and software names before fully separating direct competitive overlap from narrative spillover. Bloomberg and Investors.com both support the view that this was a sector-level reaction, not a CrowdStrike-only event. (Bloomberg.com)

At the same time, the technical boundary still matters. Anthropic’s own announcement describes a limited research preview focused on codebase vulnerability scanning and patch suggestions for human review, which is not the same thing as replacing runtime detection, endpoint visibility, identity controls, or incident response workflows. (Anthropic)

So the clean conclusion is this:

The market moved on a broad future-risk narrative first. The detailed product and budget differentiation work comes later.

That is the logic behind the move, and it is much less random than it looked at first glance.

Links

- https://penligent.ai/

- https://www.penligent.ai/hackinglabs/category/cve/

- https://www.penligent.ai/hackinglabs/cve-2026-2441-the-chrome-css-zero-day-you-dont-patch-on-faith-you-prove/

- https://www.penligent.ai/hackinglabs/cve-2026-2441-the-chrome-css-zero-day-that-starts-inside-the-sandbox-and-rarely-ends-there/

- https://www.penligent.ai/hackinglabs/cve-2025-4517-the-python-tar-extraction-bug-that-breaks-trust-boundaries-in-real-automation/

- Anthropic announcement: Claude Code Security (Feb 20, 2026) (Anthropic)

- Bloomberg coverage of cyber-stock selloff (Feb 20, 2026) (Bloomberg.com)

- Investors.com coverage and analyst commentary on budget pressure concerns (Investors)

- Google Chrome Releases stable update (CVE-2026-2441 fix and in-the-wild exploitation note) (Chrome Releases)

- NVD record for CVE-2026-2441 (description, KEV context, change history) (NVD)

- CrowdStrike investor relations filings (platform/business context) (CrowdStrike)